What are perpetual swaps?

https://medium.com/derivadex/what-are-perpetual-swaps-130236587df2

Aditya Palepu, May 2020

Perpetual swaps have quickly become the most popular way to trade cryptocurrencies. Given how popular they are, it might be a little embarrassing to ask about the basics. What exactly are perpetual swaps? Why are they so popular? And how can they help your trading strategy?

Perpetual swaps are derivatives that let you buy or sell the value of something (that something is usually called an “underlying asset”) with several advantages: 1) there is no expiry date to your position (i.e., you can hold it as long as you want), 2) the underlying asset itself is never traded (meaning no custody issues), and 3) the swap price closely tracks the price of the underlying asset, and 4) it’s easy to short.

Want to start trading perpetual swaps in the most open, secure, performant, and rewarding way? Sign up for the DerivaDEX mailing list and join the community today. We’re launching the next generation of decentralized perpetual swaps and derivatives on Ethereum.

tl;dr

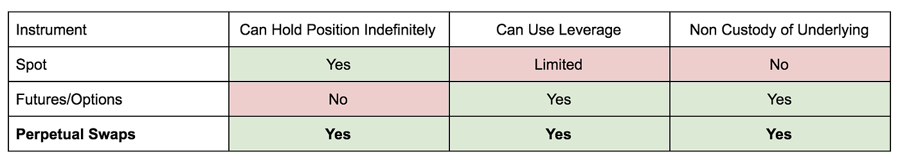

If you want to bet on the price of Bitcoin going up, you have several options. You could go to a spot exchange and purchase actual Bitcoin with your funds at the specified exchange rate. This immediately transfers Bitcoin into your possession for however long you’d like. Or you could go to the derivatives markets and buy an options or futures contract. These contracts do not immediately settle or transfer any Bitcoin to you, but they do allow you to increase your “buying power” (i.e., using derivatives, you can buy more Bitcoin and profit more from its price movements than you would otherwise be able to on the spot markets). However, options and futures contracts expire at a certain date, meaning you have to constantly manage and reestablish your positions. For traders who want the benefits of derivatives, but don’t want to deal with the complexity of expiration dates, there’s another option, one that dominates the crypto markets: the perpetual swap.

The perpetual swap is a fairly new type of financial derivative. Unlike the futures and options markets, perpetual swaps do not expire and do not have a settlement date, meaning you can hold your position forever. Unlike the spot markets, the underlying asset is never involved directly, so you can gain exposure to an asset’s price movements without having to actually hold or borrow the asset itself. And lastly, unlike futures contracts where the price can deviate from the spot underlying price (commonly referred to as basis), perpetual swaps should always be closely pegged to the underlying they track. This is accomplished with something called a “funding rate mechanism”, which you can think of as either a fee or a rebate for traders to hold positions. This mechanism balances the buyer and seller demand for the perpetual swap so that its price falls in line with the underlying asset.

It can sound intimidating without the context provided above, but given all of these advantages, you can see how powerful perpetual swaps can be for traders. Now, add in the fact that you can take on a position with varying degrees of leverage (did someone say 100x?), and you can see why all of these properties have driven perpetual swaps into the spotlight as the darling of the crypto trading ecosystem.

Cool, but show me an example!

Fair enough! To give you a concrete example of how perpetual swaps work, we’ll take a look at the 2019 activities of hypothetical trader Alice, who believed the price of Bitcoin would go up and wanted to find a smart way to execute her trade.

At the start of April 2019, BTC/USD was trading at roughly $4,000. Alice wanted to bet on a rise in Bitcoin price relative to USD, so she bought 2 BTC/USD perpetual swap contracts using $8,000 of collateral.

$8000 / $4000 = 2 BTC/USD perpetual swap contracts

Until the end of June 2019, the Bitcoin spot price steadily rose in dollar value to about $14,000. As part of the funding rate tethering mechanism (this is how a perpetual swap stays close in price to the underlying asset), Alice periodically lost a fee or received a rebate to her account. We describe this further below, and will in much greater detail in a separate post, so don’t worry if this doesn’t make perfect sense yet!

Alice, being a hypothetical trader, timed the market very well. She eventually closed her position after almost 3 months at the local maximum of $14,000. In this scenario, her profits, not considering the periodic funding rate fees or rebates, were $20,000.

profit = position_size * (current_price - entry_price)profit = 2 * (14,000 - 4,000)profit = 20,000Nicely done, Alice! She did this all without ever holding any Bitcoin at any point.

The bottom line

Perpetual swaps are a cleverly-designed derivative type that have taken the market by storm, dominating volumes on most of the leading exchanges. It combines desirable qualities of the spot and futures markets, and enables traders to use high leverage without the headache of rolling over expiring futures contracts. As with any leveraged trade, especially with volatile assets like Bitcoin, these trades can be risky! Make sure you understand them in full before participating.

I want to learn more!

Can you explain funding rate and how these contracts track the underlying price so closely?

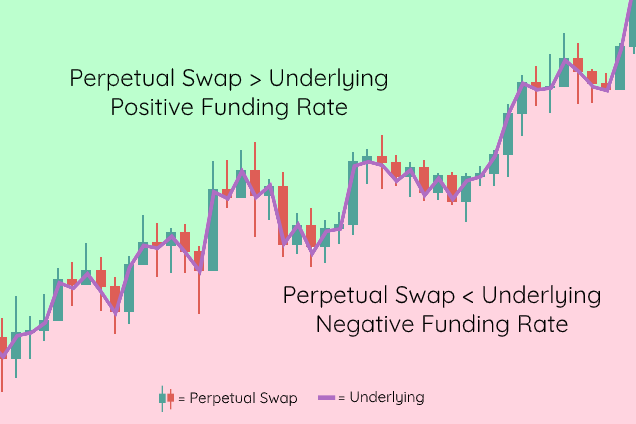

Funding rates are the magic behind how perpetual swaps track the underlying asset’s spot price. The following better illustrates the relationship between perpetual swap price, underlying price, and funding rate:

Let’s consider the two scenarios depicted above:

Perpetual swap trades above the price of the underlying (green area): when a perpetual swap has been trading above the price of the underlying, the funding rate will be positive. Long traders will pay short traders, thus disincentivizing buying and incentivizing selling, lowering the perpetual swap price to fall in line with the underlying asset.

Perpetual swap trades below the price of the underlying (red area): when a perpetual swap has been trading below the price of the underlying, the funding rate will be negative. Short traders will pay long traders, thus disincentivizing selling and incentivizing buying, raising the perpetual swap price to fall in line with the underlying asset.

The exact methodology for computing funding rates and how the payments are carried out vary from exchange to exchange and will be studied in another post. To give you a sense of the magnitude, funding rates generally oscillate somewhere between the range of -0.025% and 0.025%. This range implies that every funding period (for example, every 8 hours), a trader who had a Bitcoin perpetual swap position on worth $100,000 would either pay or receive a funding fee of 0.025% * 100,000 = $25. The important takeaway for now is that a perpetual swap fundamentally stays in line by balancing supply and demand by paying an interest rate. If the price of the perp is close to spot, the interest rate is small to bring it back into line. The farther off it gets, the higher the interest rate.

What exchanges currently offer perpetual contracts and on what products?

Since the initial unveiling of the perpetual swap, BitMEX’s XBTUSD, there have been many new offerings. Several of the prominent exchanges (and inception date) driving volumes are:

BitMEX (May 2016)

ByBit (December 2018)

OKEx (December 2018)

Binance (September 2019)

FTX (October 2019)

Huobi (April 2020)

dYdX (May 2020)

As far as underlying assets go, some specialize in a limited offering (such as BitMEX, with only Bitcoin, Ether, and Ripple) while others really pride themselves in a broad array of offerings (looking at you, FTX). To get a sense of how the centralized exchanges in the list above stack up with respect to daily volumes, refer to the following illustration:

How do you open a perpetual swap position?

Opening a perpetual position can be done using any of the exchanges above, among others. The mechanics vary from exchange to exchange, but for simplicity’s sake, we will describe one of the more intuitive patterns:

You can first deposit USD to the exchange, serving as collateral to back your position.

Upon doing so, you can then submit an order signifying how many contracts you would like to purchase and at what price.

When you order is matched and settled, you will have a position notional value equal to

amount * price. The position will carry certain attributes along with it, most notably a leverage and margin fraction necessary to understand your risk-to-reward profile and assess liquidation and auto-deleveraging risk. We will address liquidation and auto-deleveraging in very great detail in another post. Leverage and margin fraction are computed as follows:

It’s common practice in the crypto derivatives world to allow for up to 100x leverage, meaning you can take on a position worth 100 times more than your collateral.

Let’s take a concrete example to better understand:

Alice deposits $100,000 of collateral to the exchange

Alice decides to purchase 20 BTC/USD perpetual swap contracts at a price of $10,000 each

The exchange successfully matches her full order at the price she intended, and she now has a position worth

20 * 10,000= $200,000. Since she only has $100,000 collateral deposited (to simplify things, we assume the current price of BTC/USD is still at $10,000, meaning her position has no unrealized profit and loss associated with it, thusaccount_value = collateral), her leverage would be200,000/100,000= 2x. Her margin fraction would be1/2= 50%. This has implications for her liquidation risk, which we will cover in another post.

What does profit & loss look like when closing positions?

Let’s assume position liquidation does not occur — we will cover this in depth in a subsequent post. Perpetual swaps can either adhere to inverse nonlinear or linear settlement procedures, with payout profiles that look like this:

Inverse Nonlinear settlement: Perpetual swaps began as inversely settled futures, meaning that they were settled in crypto instead of USD. This allowed exchanges to not have to have exposure to the traditional banking system and live entirely in the crypto sphere. Traders deposit BTC to begin with and these contracts settle in the base currency as opposed to the quote currency, meaning if you were to trade BTC/USD, you would actually receive your payout in BTC itself. The nonlinearity arises from the fact that as you profit from a long position in BTC, you will receive a BTC payout, but in a smaller amount since BTC itself is more expensive relative to USD. On the flip side, if BTC/USD drops in value, you will be losing BTC at a greater rate since BTC itself is cheaper relative to USD. BitMEX is an example of an exchange that offers this style of perpetual swap.

Linear settlement: With the rise of stablecoins, exchanges now offer liquid linearly-settled contracts that avoid touching fiat, but pay out with more intuitive USD-like assets, such as USDT. FTX is an example of an exchange that offers this type of perp swap. Such contracts demonstrate a more typical linear PNL profile, as shown above.

For simplicity, we will look at these linearly-settled contracts as they are more intuitive and growing in demand with an example. Alice decides to purchase 20 BTC/USD perpetual swap contracts at a price of $10,000 each. She checks back 6 months later to find that Bitcoin is trading at $20,000. Excitedly, she decides to sell 20 BTC/USD perp swaps, thereby closing her position. Her profits would roughly be position_size * (close_price — average_entry_px) = 20 * (20,000 — 10,000), which equals $200,000. I say roughly because, keep in mind, during the 6 months she’s held the position, she will also gain/lose any funding rate related payments along the way.

How active are the perpetual swap markets compared to the spot markets?

Since their inception, perpetual swaps have dominated trading volumes across a number of trading venues by several multiples over their spot counterparts. Take a look at 24hr volumes of exchange-traded BTC/USD on two of the leading exchanges (Binance and FTX):

What are the pros and cons of perpetual swaps?

Pros

No expiry: You can hold a position forever without having to worry about the mechanics of rolling a position over from one futures contract to the next.

Make (a lot) more with (a lot) less: You can trade upwards of 100x leverage on some of these exchanges. This means that you can get the upside of 100x your collateral amount. Put differently, if BTC/USD is trading at $10,000 and you were to use $10,000 to buy Bitcoin on the spot markets, you could only buy 1 BTC. However, if you decided to go 100x leverage on a perpetual swap, you could get the upside of 100 BTC for the same $10,000 collateral.

Liquidity: As the most traded product, perpetual swap markets have strong liquidity profiles, making it easier for buyers and sellers to participate.

Cons

Lose (a lot) more: With great power comes great responsibility — going 100x leverage gives you much less downside protection before your position starts getting liquidated.

Funding rate costs: While in theory you could stand to gain from receiving funding rate payments, generally speaking, the funding rate mechanics work against popular trades. Meaning if most people are long BTC and you also want to be long BTC, you are most likely paying a funding rate fee to all the shorts who are keeping the perpetual swap price in line. This ultimately lowers the returns for consensus positions.

Last updated