Is Bitcoin really triple-entry accounting?

Juan Ibanez, Mar 1993

It is often claimed that Bitcoin is revolutionary because it is the first triple-entry accounting system in history. But is this really so?

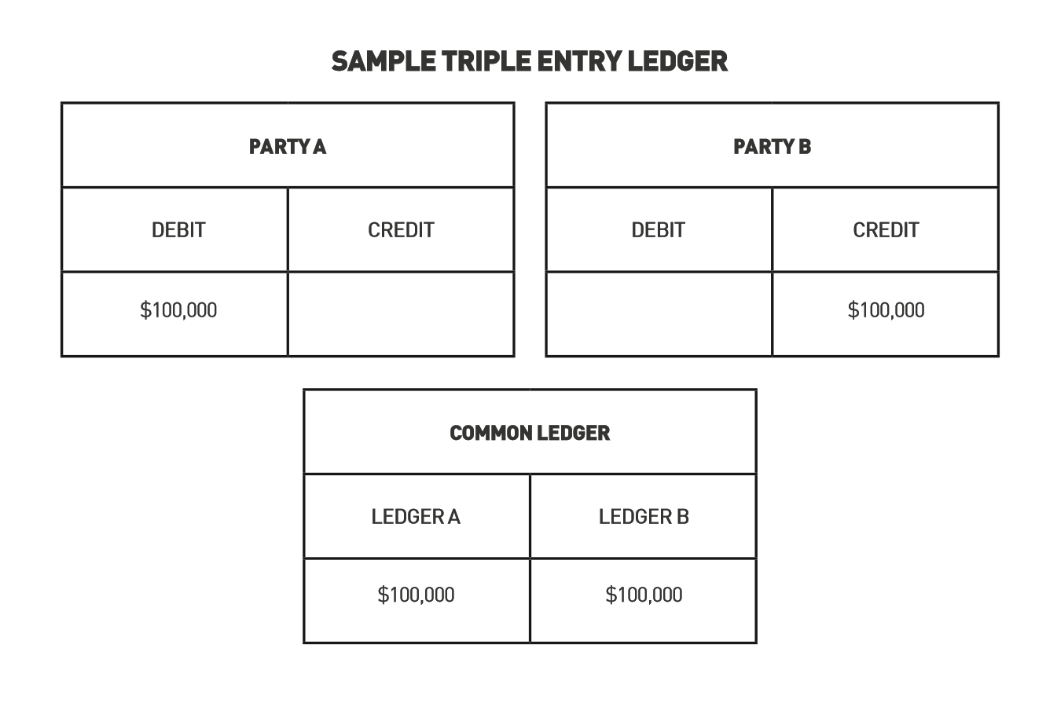

To answer this, we must first ask what triple-entry accounting is. A quick Google search will provide an answer like the following: triple-entry accounting is using blockchain to build a common ledger between two parties that would typically maintain two separate, redundant, double-entry ledgers.

Triple-entry accounting as a common ledger. Source: Ledgerium.

This is not exactly right. Triple-entry accounting is a design for a common ledger, yes, but not all common ledgers are triple-entry. Triple-entry accounting is a particular model to build a common ledger through signed messages.

Ideated and developed by Ian Grigg and Todd Boyle in the 1990s and early 2000s, triple-entry accounting ensures that two parties can maintain a trustworthy shared record by sending signed messages of offer, acceptance, and validation. If Alice wants to update the shared record, she sends a signed message to Bob over a system called Ivan; if Bob agrees with the update (and his agreement is required), he replies by accepting the update in another signed message over Ivan; finally, Ivan checks the validity of the signature and, if everything is in order, signs off on the record as well.

The result is a signed receipt, which constitutes a common ledger implementing the WYSIWIS (“What You See Is What I See”) principle. In other words, Alice, Bob and Ivan can be certain (due to the nature of how cryptographic signatures work) that they all hold exactly the same record. If the entire set of receipts is read, each party’s balance can be known, which enables huge efficiency effects in accounting.

Blockchain technology, introduced by Bitcoin, presents a way to replace Ivan with a decentralized community of nodes, making the entire system more “trustless” (one does not need to personally trust a third party but only the architecture of the system itself). But is Bitcoin itself triple-entry?

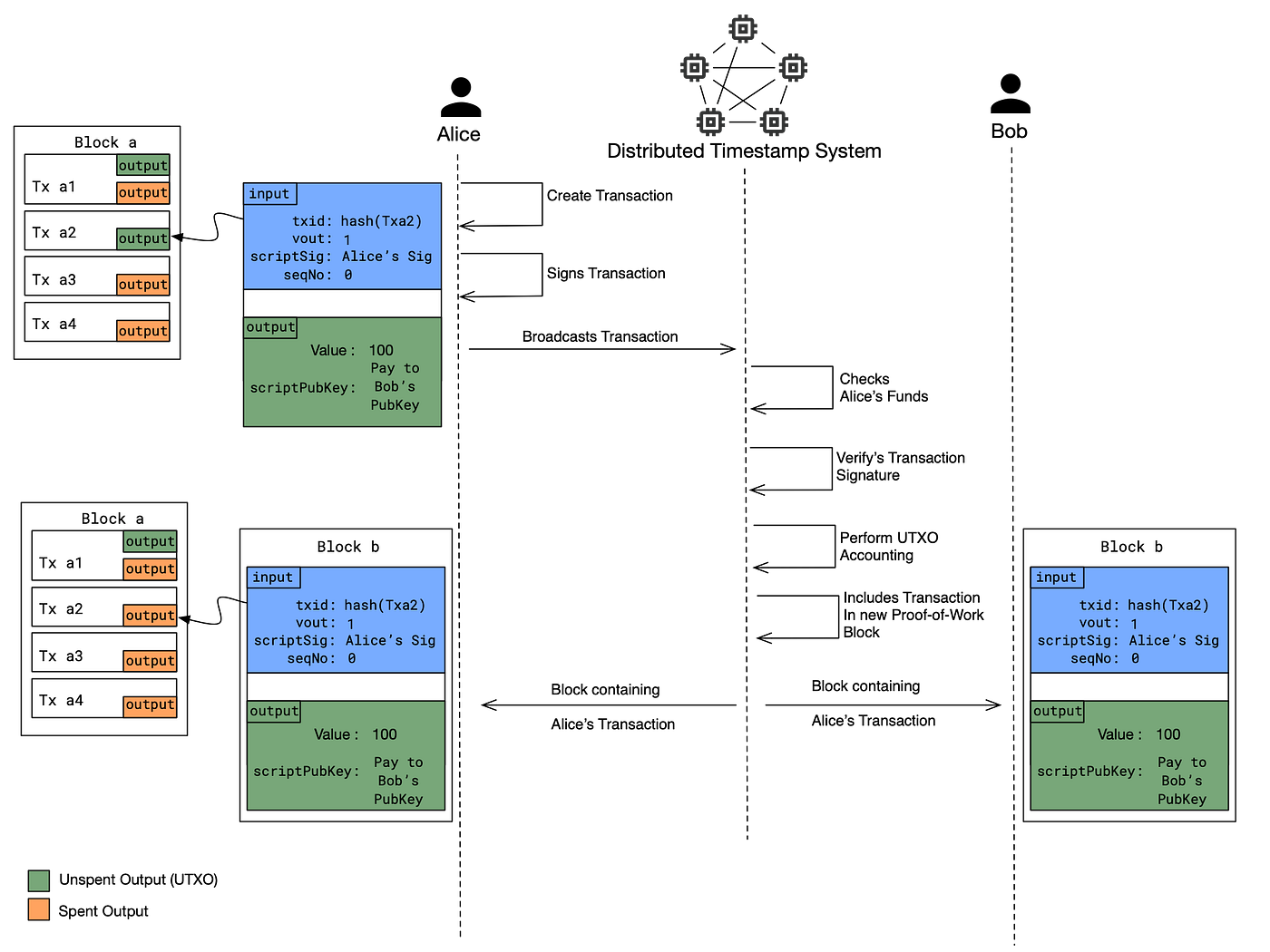

At first sight, it appears that it is not. Stephan February offers an impeccable two-part explanation of how you get from Grigg’s original triple-entry model to peer-to-peer digital cash (i.e. Bitcoin) by replacing Ivan with a distributed timestamp system. However, February himself argues that there is no third signature in this design. Furthermore, there is no second signature either!

February’s account of Bitcoin as a triple-entry system. Source: Twostack.

February’s model shows the receipt as signed by Alice only. While February argues that this is called triple-entry accounting because there is a signed receipt held by three parties, this could be seen as deviating from triple-entry accounting as we described before. Signed receipts are held by three parties, yes, but shouldn’t they also be signed thrice?

A quest for hidden signatures

Can we then say that Bitcoin is not triple-entry accounting, because there are no second and third signatures? Not necessarily. As we have argued in a recent paper, even if those signatures were necessary, they are there upon closer examination.

The second signature

Bookkeeping is keeping records of transactions, which are a bilateral event. In a sale, for example, somebody pays and somebody else delivers something in return. Bitcoin, however, is just a payment system. This means it only records (typically) one-half of the transaction, making the second signature almost unnecessary.

Todd Boyle’s triple-entry accounting looked at wide patterns of transactions as bilateral events in trade cycles (offer, acceptance, delivery, invoice, payment, etcetera). This made Bob’s acceptance necessary, e.g. for draft invoices, as there were two parties which were both giving something up. A signature was thus needed to show that both parties were consenting to give this up.

However, for a payment system in which payment is not linked to delivery, it makes little sense to attest Bob’s consent. It could be seen as a waste of time. This was the case of Ian Grigg’s original triple-entry accounting model: the Ricardo Payment System.

One can therefore argue that Bitcoin is triple-entry accounting even in the absence of a second signature, because this what triple-entry accounting looks like for a payment-only system.

Nevertheless, a second signature is found in payment systems: in the event of the receiver deciding to spend the value by signing another payment over it. In the act of signing a spend, the receiver confirms the receipt of previous funds, and in effect creates an asynchronous signature. This is broadly true of payment systems, whether they be Bitcoin, Ricardo or high street banks.

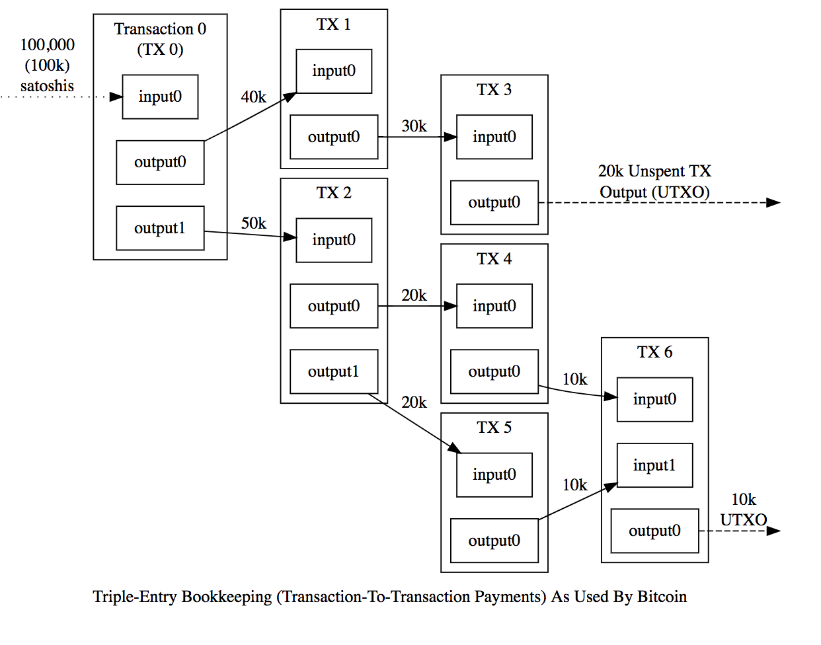

In summary, in the act of later spending the amount received, the receiver of a payment sends a signed message confirming acceptance of that payment. This also applies to Bitcoin’s UTXO (Unspent Transaction Output) model.

Bitcoin’s UTXO model. Source: Joerg Evermann.

In UTXO, the transaction input (amount sent by the payer) or inputs must equal the transaction output (amount the payee receives). If it exceeds it, it is spent anyway and returned to the payer as a new output: change. As explained in the aforementioned paper:

“The UTXO model necessarily requires the new payer (and former payee) to sign off on a message that confirms receipt of a prior payment output in its totality (or of a mining reward which resulted in the creation of new bitcoins through a coinbase transaction).”

The third signature

So, second signatures can be found even in the absence of schemes to make Bitcoin transactions bilateral. What about the third ones?

In Bitcoin, miners check for valid transactions and include them in blocks, which they do incentivized by the block reward that, together with transaction fees, they get for each block mined (the “coinbase transaction”). The community accepts this block by including the hash of this block in the next accepted block (which forms the “chain” in blockchain). Together, community consensus and the coinbase transaction act as third-party validation of the transaction (for a more detailed explanation, see the first part of February’s article). This is a signature.

Admittedly, we are using a broad concept of signature: a signature is any token that attests agreement at some point. Nonetheless, this goes in line with Ian Grigg’s design, not against it.

Conclusion

A triple-entry accounting system requires a signed receipt to be held by three parties in three places. If the transaction pattern requires this, all of the parties must have signed the receipt. Bitcoin does this and, in this sense, it is triple-entry.

To read our research in more detail, access our full paper here.

Literature

Boyle, T. 2001g. The Shared Transaction Repository (STR) ver. 0.60 spec. GL Dialtone. Available at http://linas.org/mirrors/www.gldialtone.com/2001.07.14/STR.htm

February, S. M. 2020a. Grokking Bitcoin. TwoStack. Available at https://www.twostack.org/docs/working-with-bitcoin/what-is-bitcoin/what-is-bitcoin/

February, S. M. 2020b. Triple Entry Accounting. TwoStack. Available at https://www.twostack.org/docs/working-with-bitcoin/transactions/triple-entry-accounting/triple-entry-accounting/

Grigg, I. 2005. Triple Entry Accounting. Systemics Inc. Available at https://iang.org/papers/triple_entry.html

Grigg, I. 2015. The Nakamoto Signature. Financial Cryptography. Available at http://financialcryptography.com/mt/archives/001572.html

Ibañez, J. I., Bayer, C. N., Tasca, P., Xu, J. 2020. REA, Triple-entry Accounting and Blockchain: Converging Paths to Shared Ledger Systems. Social Science Research Network (SSRN). Available at http://dx.doi.org/10.2139/ssrn.3602207

Ibañez, J. I., Bayer, C. N., Tasca, P., Xu, J. 2021. The Efficiency of Single Truth: Triple-entry Accounting. Social Science Research Network (SSRN). Available at http://dx.doi.org/10.2139/ssrn.3770034

Ibañez, J. I., Bayer, C. N., Tasca, P., Xu, J. 2021. Triple-entry Accounting, Blockchain and Next of Kin: Towards a Standardization of Ledger Terminology. Social Science Research Network (SSRN). Available at http://dx.doi.org/10.2139/ssrn.3770034

Last updated